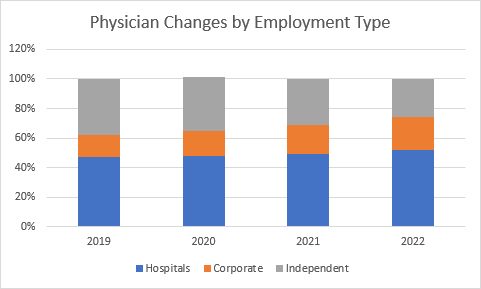

Hospitals, payers, and PE firms have been vying over the past decade to acquire independent physician groups, and COVID accelerated consolidation among physician specialties. Data reported in Cain Brothers Industry Insights¹ shows that 75% of physicians are employed by a larger entity (i.e., nonphysician owned). The hospital and independent segments are self-explanatory but the corporate segment is mix of PE firms, payers, and non provider groups that all want a bite of the healthcare apple.

We track this in the strategy research that we do for our clients and I was surprised to see that independent facilities were declining. This may be because physicians realize that the risk involved with managing a facility is very high and that working for corporate facility that is not a hospital may be a better option. While hospitals still employ the most physicians at slightly higher than 52% in 2022, corporate entities have been increasing their segment. Cain reports that the growth for corporate entities has mostly come from the southern part of the US, growing by greater than 50%.

From this data, it appears that hospitals mainly employ physicians fundamental to service lines that are pivotal to day-to-day hospital operations, like oncology, cardiology, ICU care (hospitalists), etc. No surprise, corporate entities have invested in specialties with profitable outpatient procedures and services, like orthopedics, ophthalmology, and nephrology. Expect these trends to continue, albeit with slower growth rates, because of the limited number of remaining independent practices. Relatively few specialties remain independent in the majority, like psychiatry, oral surgery, and plastic surgery. Note the decline in almost all of the top independent physician specialties—consolidation can become a strategic imperative.

I am watching Amazon and CVS, and their acquisitions of One Medical and Oak Street Health, respectively, which could be the next big disrupters but I wonder… how good will they be as employers of physicians? While hospitals remain the dominant physician employer in the near term, non-hospital employment appears to be growing unabated, as payers and investors can offer premium prices to practices relative to the struggling and more challenged hospital / health system environments.

Consolidating physician practices may not be good for medtech because the balance of power will be in the larger, consolidated healthcare organizations. And, the Cain report states that competition is growing for medical specialties that have historically been controlled by hospital entities. They cite cardiology as an example as PE and ASC-focused Corporate Owners begin to consolidate independent cardiology groups across the US and are expected to compete head-to-head with hospitals. This puts physicians back in the drivers seat, if they manage it well.

CONTACT US

LOOKING FOR A PARTNER TO UNCOVER new commercial strategies FOR YOUR MEDICAL DEVICE?

OUR LAST THREE PROJECTS WERE:

M&A due diligence analysis: strategic fit for a new disruptive product

Go to market strategy for a medtech start up

Medtech price sensitivity analysis - hospital administrators and CFOs