Thought Leadership

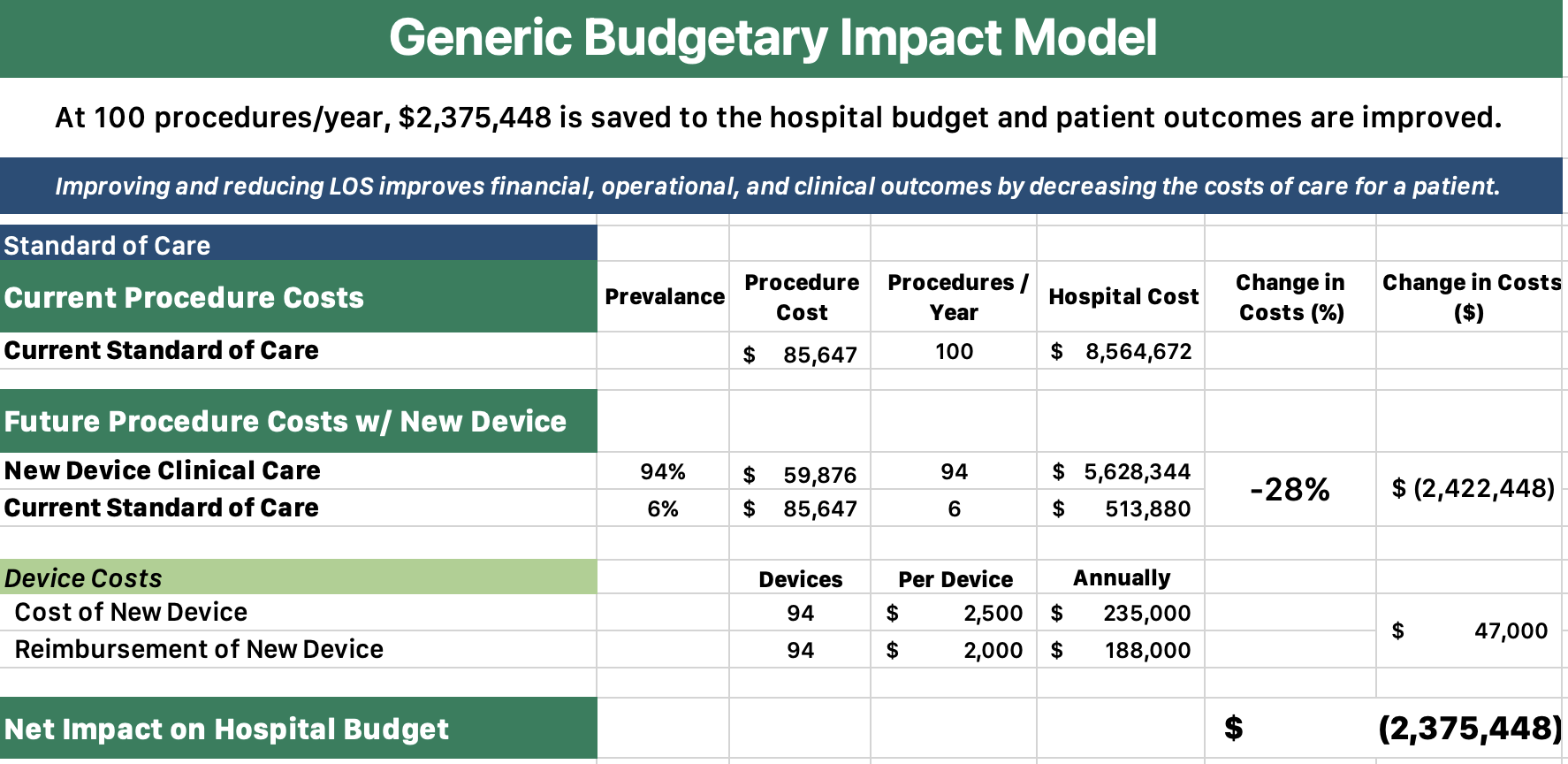

Communicating a robust economic strategy is paramount to device market success and often requires simplification into a budgetary impact model. Value analysis committees (VAC) hear presentations from medtech companies routinely and yours must stand out clearly.

Communicating a robust economic strategy is paramount to device market success and often requires simplification into a budgetary impact model. Value analysis committees (VAC) hear presentations from medtech companies routinely and yours must stand out clearly.

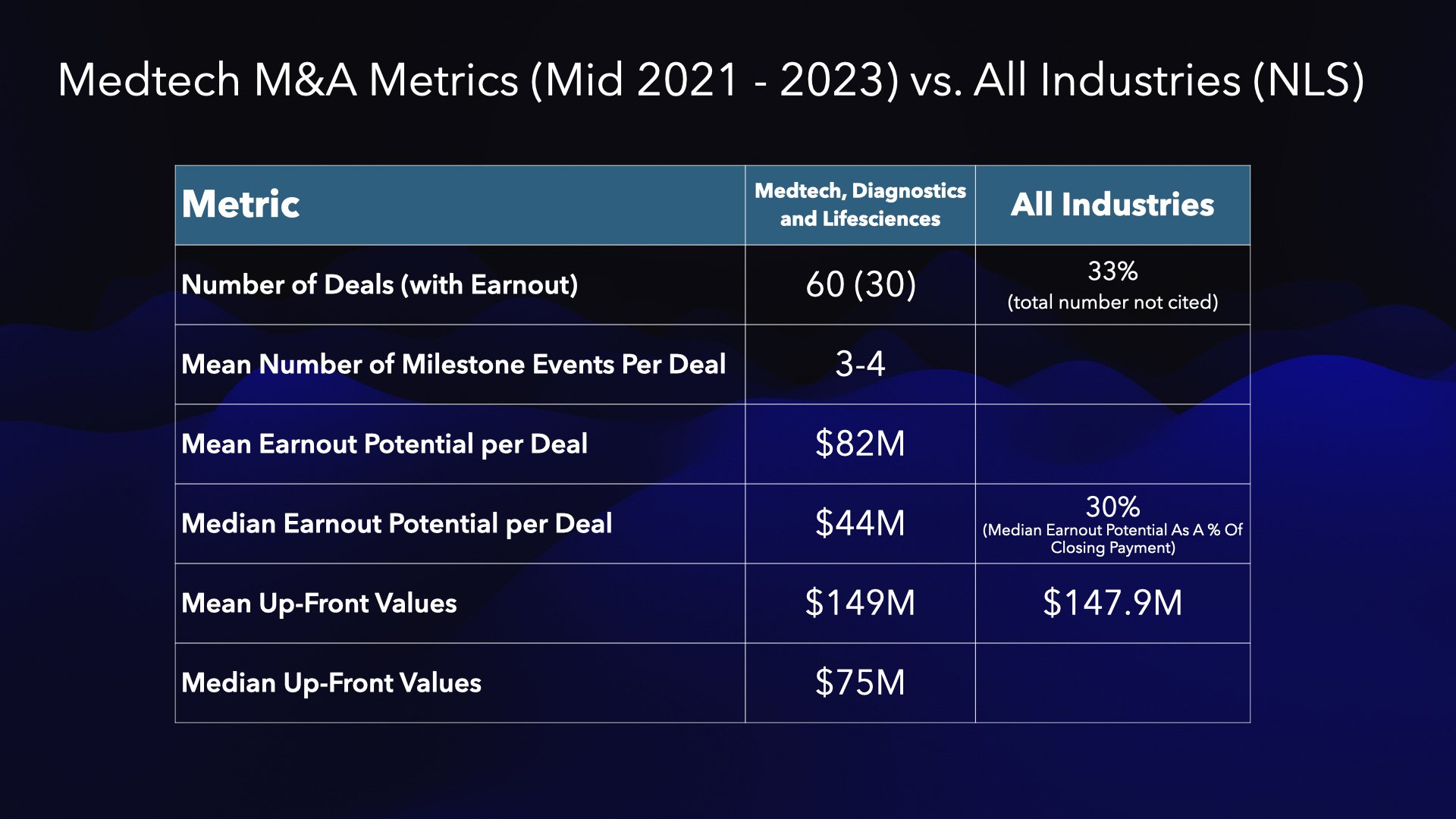

We all agree that 2023 was an inauspicious year for global medtech M&A. How are other, non Life Sciences (NLS) industries doing in Deal Terms? SRS Aquiom publishes great M&A research in the Life Sciences space for pharma, biotech and medtech. Their value proposition is that SRS Acquiom delivers the smartest way to run a deal™ with solutions that reduce the administrative burden throughout the entire deal lifecycle. Let’s compare global trends of NLS industries to Medtech.

2023 was a discouraging year for worldwide medtech M&A. According to McKinsey, in the life sciences sector, there were 745 transactions in 2023. Ninety-one percent had a value below $1 billion, and 54% fell below $100 million. Biotech and pharma deals were in the majority of deal volume—61% and 23%, respectively.

Expect the pace of medtech innovation in 2024 to meet or exceed the outstanding bump we saw in 2023. And expect price strategies for these new technologies to keep medtech marketing teams on their toes.

Organizational culture is critical for successful innovative growth and the acquisition of new and adjacent technologies. Medtech companies with robust innovation cultures generate even more value by embracing the latest technologies, such as generative AI.

For medtech, resilience over the long term includes expansion through M&A and the bravery to make bold moves to pursue unknown alliances that have a high probability to result in profitable growth.

According to McKinsey, for a CEO to beat the odds, there are 18 practices divided into six key areas of the job.

You’ve developed a great device. Now you need to get it to market, attract an acquirer, and get through negotiations.

You aren’t done yet.

By their own estimates, SRS Acquiom has partnered with buyers and sellers involved with approximately 10% of all US M&A transactions since 2008. Using data collected since then, they estimate they have been involved with 113 Medical Device deals (80 with earnouts and 33 without earnouts) and 107 Diagnostics/Research deals (52 with earnouts and 55 without).

In a hospital administrator survey (n=50) 3Q23 year over year growth was 3% for outpatient and the emergency department, 1.6% for inpatient and 2.1% for ASCs.

The ninth year of the Women in the Workplace report, (n=27,000) conducted in partnership by McKinsey and LeanIn.Org, is the largest study of executive women across corporate America and Canada.

So many medtech manufacturers are building digital and hardware ecosystems that bring extra value to customers, increase switching barriers, provide competitive advantage and differentiate from competitors.

One example area of focus is in the race between GE and Siemens to use AI-powered imaging.

What a meeting! The Bio BootCamp was attended by other former faculty and there were some very animated discussions about funding and what venture capital and medtech angels were looking for in investments. I can't remember who it was that said that “Medtech investors are pursuing statistical outliers”, but it was notable enough that I used it for the title of this article.

Mammoth retailers like Amazon, Walgreens, and even Dollar General, a trusted low-price brand in rural America, are competing for a bite of the healthcare apple, and are reported to be investing billions of dollars and creating significant expansion plans. Their goal: become dominant players in urban areas where they have a dominant footprint and the new battleground; rural America. In a report from Cain, approximately 15% of US patients live in rural areas. Many are at higher risk for cancer, heart disease, stroke, chronic respiratory issues and unintentional injuries than metropolitan patients, according to the CDC. Patients in outside of urban areas are also typically older, sicker and more apt to be lower income.

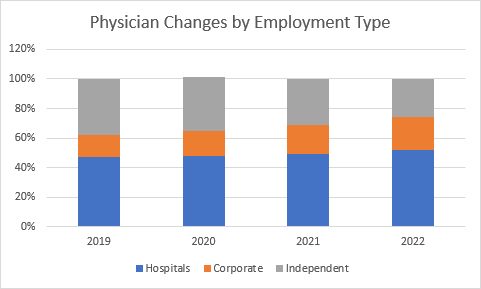

Hospitals, payers, and PE firms have been vying over the past decade to acquire independent physician groups, and COVID accelerated consolidation among physician specialties. Data reported in Cain Brothers Industry Insights¹ shows that 75% of physicians are employed by a larger entity (i.e., nonphysician owned). The hospital and independent segments are self-explanatory but the corporate segment is mix of PE firms, payers, and non provider groups that all want a bite of the healthcare apple.

Thank goodness for svb and all the good data they produce! We believe that M&A activities in our sector are poised for a great year in 2023 and I am happy to report that svb agrees with our view of the market.

During COVID, it would have been dangerous to attend JP Morgan (no way to remain 6 feet apart in all those crowded hallways packed with investors trying to get to the next deal… ). This year, the first since 2021, it was the weather where, just outside Union Square, a tree fell on a Muni bus during one of many storms that passed through San Francisco.

There was a lot to learn at AdvaMed, and the CEOs Unplugged panels did not disappoint. The US President of Siemens Healthineers, David Pacitti, talked about how COVID pushed them to new strategies where Siemens Healthineers is working with the hospital C-Suite to sell medical imaging equipment such as fluoroscopy equipment, MRI, X-ray, ultrasound and CT scanners. The Siemens Healthineers 10-year plan focuses “less on the box,” the big iron, and more on the customer journey.