We all agree that 2023 was an inauspicious year for global medtech M&A. How are other, non Life Sciences (NLS) industries doing in Deal Terms? SRS Aquiom publishes great M&A research in the Life Sciences space for pharma, biotech and medtech. Their value proposition is that SRS Acquiom[i] delivers the smartest way to run a deal™ with solutions that reduce the administrative burden throughout the entire deal lifecycle. Let’s compare global trends of NLS industries to Medtech.

The SRS Acquiom 2024 M&A Deal Terms Study analyzed greater than 2,100 private company (NLS) acquisitions of approximately $475B that closed between 2018 to 2023.

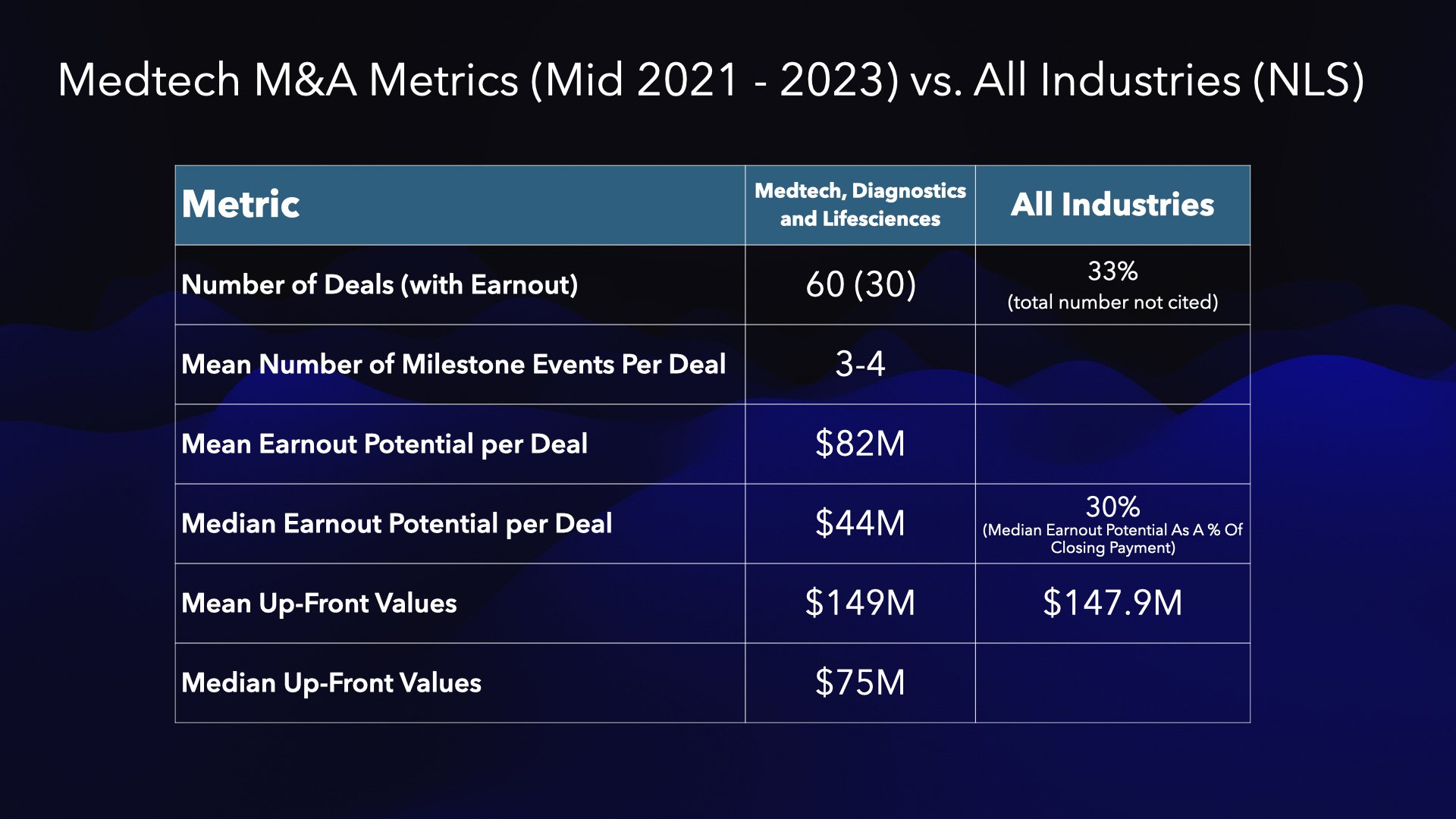

According to the SRS Acquiom Life Sciences study[ii], medtech, diagnostics and life sciences (which are aggregated in the Life Sciences numbers), deal counts in 2021 and 2022 were more than twice those of prior years. In the chart below, we compare NLS valuations to Life Sciences valuations.

While comparing NLS valuations may not be practical, even if similar, they provide a benchmark for medtech.

Thirty-three percent of the 2023 NLS deals had an earnout. Thirty-five percent of those earnout deals had a single milestone triggering the earnout and 65% had multiple milestone triggers, such as revenue, earnings, and others.

Deal size trends observed in the 2022 NLS M&A market continued into 2023 with lower valuations and a focus on lower middle-market (less than $50 million) deals The average and median ROI for 2023 NLS deals was 6.3x and 2.5x, a reduction from 9.1x and 4x in 2022, respectively. The median and average exit timing for NLS M&A targets continued to increase from 6.5 and 7.0 years in 2022 to 6.7 and 7.3 years in 2023.

The frequency of deals with management carveouts almost doubled in size in 2023 as compared to 2022. The median carve-out size as a percentage of transaction value in 2023 dropped to 6.8% from 10% in 2022.

U.S. public and private strategic buyers were more active in 2023, with a parallel significant drop by U.S. private buyers backed by private equity.

M&A trends are changing in medtech, not doubt influenced, in part, by emerging trends in the NLS market. M&A due diligence is one of our sweet spots here at Medi-Vantage. We help investors with M&A due diligence to be sure the claims that entrepreneurs are making are sound and complete and meet the needs of the acquirer and end user.

CONTACT US

LOOKING FOR A PARTNER WITH MEDICAL DEVICE M&A STRATEGY EXPERTISE WITH CLINICIANS, HOSPITAL ADMINISTRATORS AND HOSPITAL CFOS?

OUR LAST 4 PROJECTS:

M&A due diligence analysis for a new disruptive product in cardiology

M & A due diligence for a mid-market tuck in

Medtech price sensitivity analysis

Price Strategy & Budgetary Impact Model Development for a novel and disruptive medtech product