I always like to take a read on the thoughts and opinions of leaders outside of our medtech industry, especially during a period of unrest like we’ve seen during the pandemic. There is much good information in The GLG CEO Survey 2022 report (n=471 CEOs) where CEOs shared their strategies and what they expect will happen next five years, especially about knowledge-based employees that can work from home independently as long as they have well-defined expectations[i].

CEOs reported their 2021 corporate results and then forecasted their 2022 results. This survey, done in 1Q22, was optimistic, but also reported cautious strategies such as cost cutting non-customer facing services and employees, streamlining operations, and higher levels of technology in the buying process to reduce the need for clients to reach out to customer service.

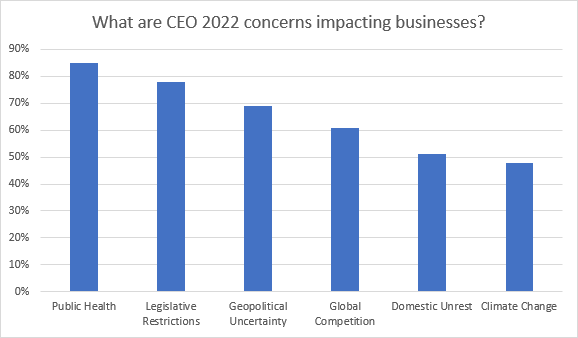

CEOs recognize the impact of COVID and stated the need for strengthening global system, employee retention strategies, fortifying the supply chain, and recruiting a strong bench. This is demonstrated in the chart below.

What are CEO concerns impacting their businesses in 2022?

Having employees work from home has not been an easy process for many organizations. One CEO reported extensive investment in cybersecurity and IT infrastructure to safely utilize collaboration tools.

Internal investments for Sales and Marketing leap ahead of R&D and innovation in 2022

Respondents were asked; compared to 2021, how will your company change its internal investments in 2022? In a shift away from 2021 where R&D and Innovation ranked at the top at 59%, most of the CEOs surveyed realigned their internal investments to sales (70%) and marketing (66%). There was an expectation that employee headcount would increase in 2022 with 49% of CEOS reporting a slight increase and 16% reporting a large increase. This increase could come at a high cost. In a McKinsey report; The CEO agenda in 2022: Harnessing the potential of growth jolts, the authors noted the impact of deliberate attrition, which has increased by approximately 800,000 in since 2020, while forced attrition decreased by approximately 400,000 during the same period. The impact? Medtech companies need to discover new methods to retain and develop talent and increase efficiency at the same time.

CEO Predictions for Internal Investment Changes in 2022

Top business priorities for CEOs were digital and technological capabilities: 60%, customer experience: 59%, innovation: 58%, human capital: 58%, supply chain and logistics: 40%, cyber security and big data: 26%, adaptation to uncertain external environments: 24%. When queried, 92% of CEOs indicated that supply chain issues will continue to impact their businesses and the global economy well into 2022.

The Medi-Vantage take

One CEO client told me that she thought the work from home model was a good one, but she was worried that it was not sustainable. In an industry like medical devices that is dependent upon relationships with physicians, surgeons, hospital administrators, nurses and patients, getting the insights we need to create new medical devices can be challenging. Voice of the customer has remerged as a robust tool to expand those relationships and advance the insights that we must have to develop innovative new products for our medical device customers.

CONTACT US

LOOKING FOR A PARTNER WITH KEY DUE DILIGENCE INSIGHTS FOR MEDICAL DEVICE M&A WITH CLINICIANS, HOSPITAL ADMINISTRATORS AND HOSPITAL CFOS?

OUR LAST THREE PROJECTS WERE:

M&A due diligence analysis: strategic fit for a new disruptive product

Go to market strategy for a medtech start up

Medtech price sensitivity analysis - hospital administrators and CFOs