You’ve developed a great device. Now you need to get it to market, attract an acquirer, and get through negotiations.

You aren’t done yet.

By their own estimates, SRS Acquiom has partnered with buyers and sellers involved with approximately 10% of all US M&A transactions since 2008. Using data collected since then, they estimate they have been involved with 113 Medical Device deals (80 with earnouts and 33 without earnouts) and 107 Diagnostics/Research deals (52 with earnouts and 55 without).

The frequency of earnouts has varied by sector over the years in the life sciences. Medical devices have a higher incidence of earnouts than the Diagnostics/Research sector. A comparison to the non-life sciences sectors shows that earnouts are far less frequent outside of the life sciences industry.

According to the American Bar Association, the practice of earnouts in the life-sciences using regulatory and other unique milestones are not common in the tech, finance or other industries. The authors of the article; Anatomy of an Earnout in the Era of COVID-19: Best Practices for Designing Earnouts to Avoid Disputes indicate that outside of life-sciences, buyers and sellers are largely cautious of using earnouts to bridge a valuation gap. This is because in some earnout disagreements, the source of the misunderstanding was that the earnout construct was a poor way to bridge the valuation gap. This means the buyer and seller had incompatible expectations for the earnout, and their goals were not allied after closing the deal.

The trend chart above does not tell the complete story. Comparing earnout potential and payments in 2021 vs 2023 (YTD October 2023), in 2021, in the life sciences, unpaid milestones were logged at $54.1 B (92%) with $4.7B paid earnouts. By percentage, there was not much change by 2023 YTD (October 2023). $65.7 B of earnouts were left on the table (91%) and unpaid and $6.5B were paid, approximately 9%.

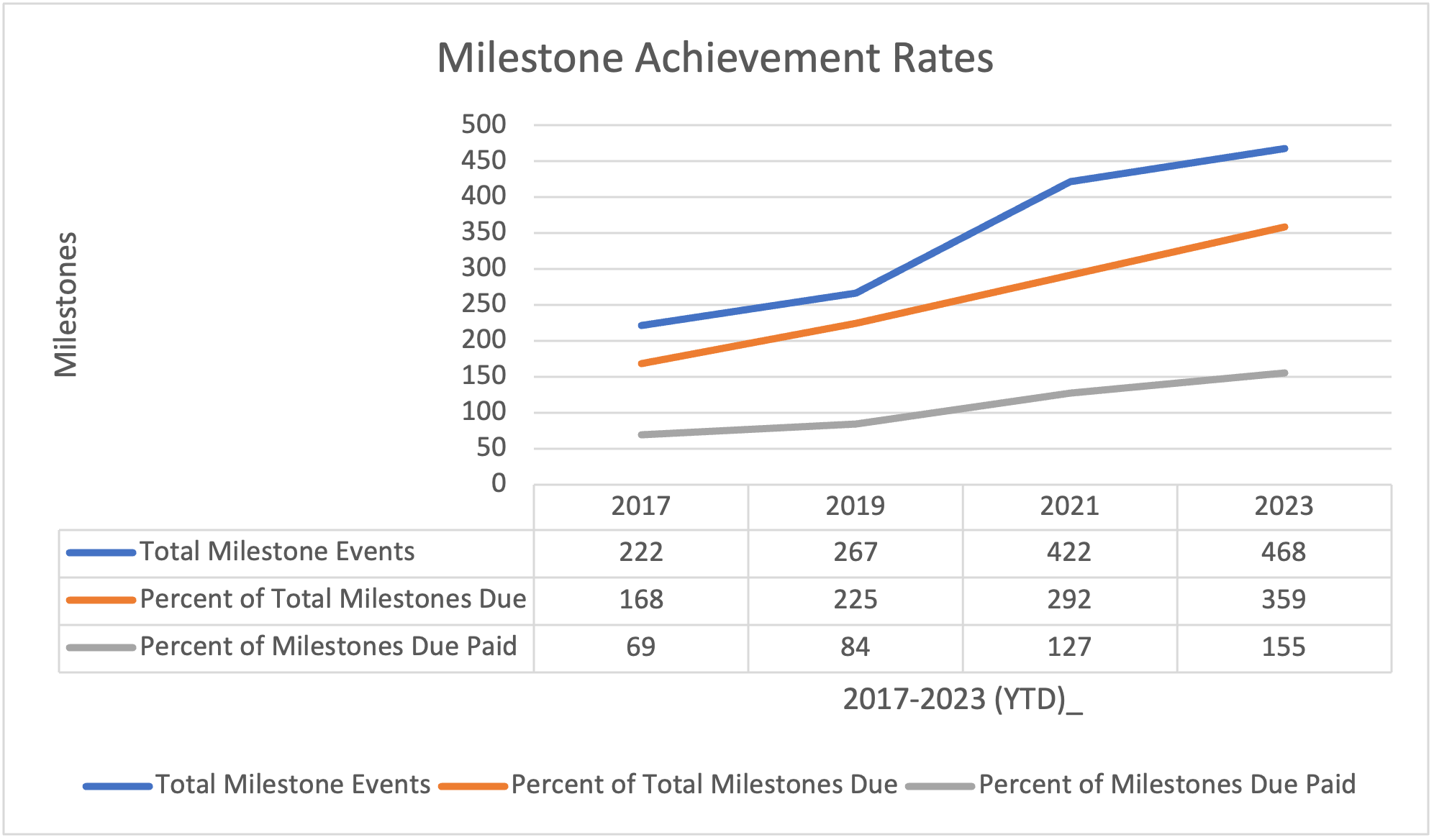

Milestone achievement rates for medical devices and diagnostics were also low. Between 2017 and 2023 YTD the chart below compares the total number of milestone events, the percent of totals milestones that were due and of those milestones due, those that were paid.

A gloomy statistic is that of 108 medical device, diagnostic and research deals with a minimum of one milestone by 2Q23, 43% had no earnouts, 23% had 75-100% of their potential earnout paid, 6% had 50-75% paid, 15% had 25-50% paid and 13% had >0 -25% paid.

CONTACT US

LOOKING FOR A PARTNER TO UNCOVER new commercial strategies FOR YOUR MEDICAL DEVICE and bring in M&A Experts for your Negotiations?

OUR LAST THREE PROJECTS WERE:

Voice of the customer: for a medtech client looking for a digital app to build a strong switching barrier to their commoditized device.

Price strategy research for a new disruptive medtech device.

M&A due diligence for a client considering acquisition of a complex use medical device.

Footnotes

1. 2023 Life Sciences M&A Study, SRS Acquiom (September 2023)

2. Anatomy of an Earnout in the Era of COVID-19: Best Practices for Designing Earnouts to Avoid Disputes, Business Law Today (August 17, 2020)