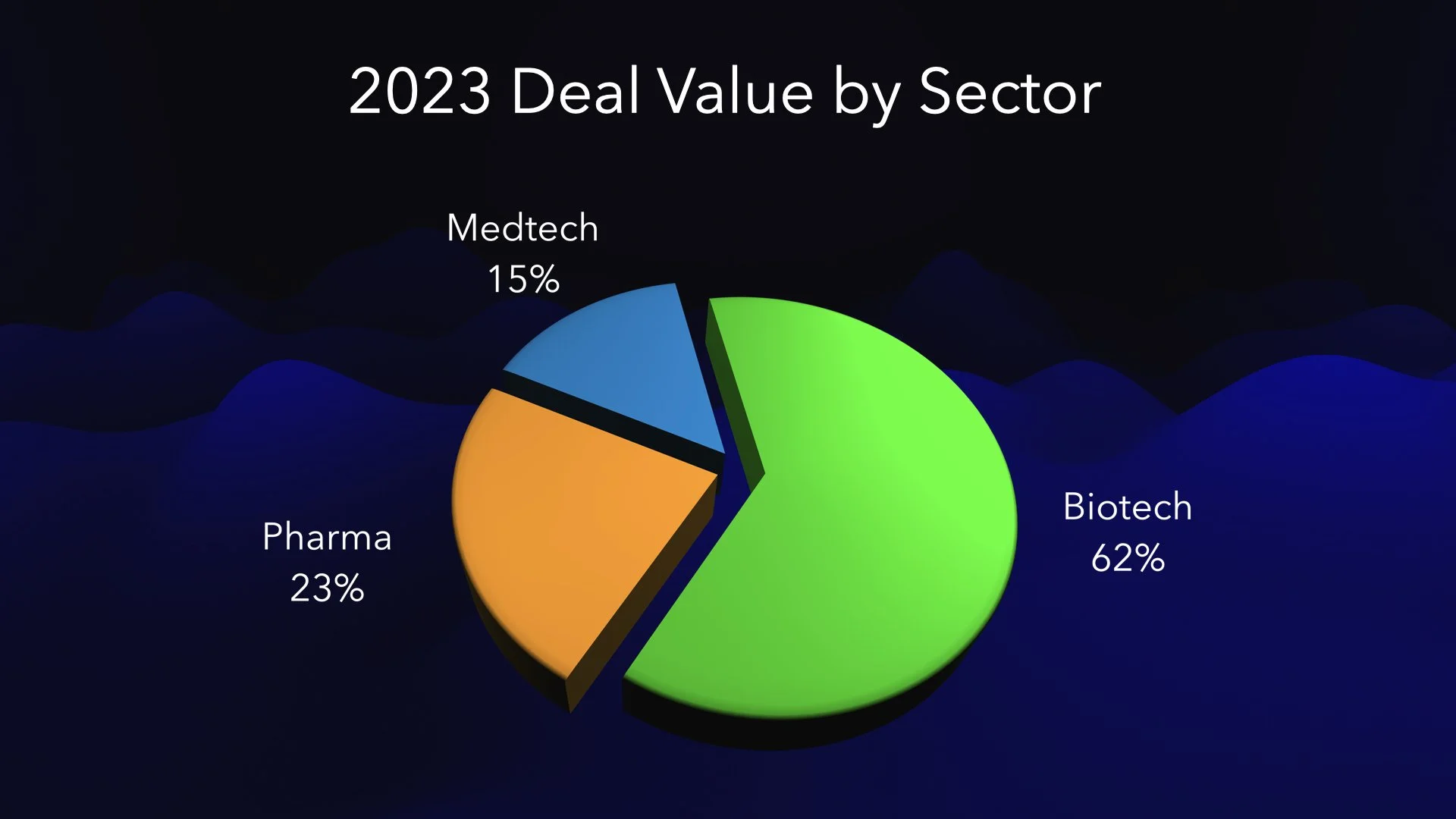

2023 was a discouraging year for worldwide medtech M&A. According to McKinsey, in the life sciences sector, there were 745 transactions in 2023. Ninety-one percent had a value below $1 billion, and 54% fell below $100 million. Biotech and pharma deals were in the majority of deal volume—61% and 23%, respectively.

In medtech, 2023 notable acquisitions included Globus Medical’s acquisition of Nuvasive in a $3.1 billion, all-stock deal. ThermoFisher announced their intention to acquired Olink Holding for its high-throughput protein analysis technology, also for $3.1B[i].

There was not as much M&A as hoped for or expected, probably due to the combined effects of interest rates and inflation. Acquirers grappled with higher funding costs while negotiating the valuations calculated by sellers. The uncertainty of economic forecasts and interest rates were a headwind for M&A in 2023.

However, as noted above, M&A activity was not completely hampered. There was M&A enthusiasm from well-capitalized medtech strategic buyers. 2023 showed activity in the corporate sector, who have continued appetite for deals and carve-outs that transform portfolios, as well as portfolio acquisitions and divestments more focused on the mid-market.

We believe 2024 M&A is going to accelerate after the slowdown of the past two years, as startup medtech companies launch new products, achieve regulatory clearances or reach other milestones and macroeconomic conditions recover. According to McKinsey, life sciences deals grew by 23% in 2023, a trend we expect to continue, based on some of the 1Q24 M&A activity we’ve seen, and the pent-up demand for new technologies by large medtech companies. At the same time, according to McKinsey, smaller medtech transactions delivered 29 percent of the deals in 2023, but only 15 percent of deal value. We think this will change and grow in medtech 2024.

M&A due diligence is one of our sweet spots here at Medi-Vantage. We help acquirers with M&A due diligence to be sure the claims entrepreneurs are making are sound and complete and meet the needs of the acquirer and end user.

CONTACT US

LOOKING FOR A PARTNER WITH MEDICAL DEVICE PRICE STRATEGY EXPERTISE WITH CLINICIANS, HOSPITAL ADMINISTRATORS AND HOSPITAL CFOS??

OUR LAST 4 PROJECTS:

M&A due diligence analysis for a new disruptive product in cardiology

M & A due diligence for a mid-market tuck in

Medtech price sensitivity analysis

Price Strategy & Budgetary Impact Model Development for a novel and disruptive medtech product

Footnotes

Thermo Fisher buys Olink Holding for $3.1B, pushing further into proteomics (October 17, 2023).